Introduction to Cure Auto Insurance. As a responsible driver, it is crucial to have the right auto insurance coverage to protect yourself, your vehicle, and others on the road. In this comprehensive review, I will introduce you to Cure Auto Insurance, a reputable insurance provider that offers a wide range of coverage options. Whether you are a new driver or have years of experience behind the wheel, Cure Auto Insurance has policies tailored to meet your specific needs.

Cure Auto Insurance is a recognized name in the industry, known for its commitment to providing affordable and reliable coverage. With a strong presence in the market, Cure Auto Insurance has garnered a reputation for excellent customer service and competitive rates. Their focus on offering quality insurance at affordable prices sets them apart from other providers.

Benefits of Choosing Cure Auto Insurance

Contents

- 1 Benefits of Choosing Cure Auto Insurance

- 2 Coverage Options Provided by Cure Auto Insurance

- 3 Customer Reviews of Cure Auto Insurance

- 4 Contacting Cure Auto Insurance – Phone Number and Login Information

- 5 Comparing Cure Auto Insurance to Other Providers

- 6 Discounts and Savings Opportunities with Cure Auto Insurance

- 7 Auto Insurance Requirements in Michigan and How Cure Auto Insurance Meets Them

- 8 How to File a Claim with Cure Auto Insurance

- 9 FAQ

- 10 Conclusion – Is Cure Auto Insurance the Right Choice for You?

When it comes to selecting an auto insurance provider, it’s essential to consider the benefits they offer. Cure Auto Insurance goes above and beyond to ensure their policyholders receive exceptional service and value for their money.

One significant advantage of choosing Cure Auto Insurance is their commitment to affordable rates. They understand that insurance premiums can be a burden for many individuals, and they strive to provide policies that fit within your budget. With their competitive pricing, you can enjoy the peace of mind that comes from knowing you are protected without breaking the bank.

In addition to affordability, Cure Auto Insurance offers flexible coverage options. Whether you are looking for basic liability coverage or comprehensive protection that includes collision and comprehensive coverage, they have policies to suit your needs. Their knowledgeable agents can guide you through the process of selecting the right coverage options for your unique circumstances.

Coverage Options Provided by Cure Auto Insurance

Cure Auto Insurance offers a comprehensive range of coverage options to ensure you have the protection you need on the road. Let’s explore some of the coverage options they provide:

- Liability Coverage: This coverage protects you if you are at fault in an accident that causes bodily injury or property damage to others. It covers medical expenses, legal fees, and property repairs or replacements.

- Collision Coverage: If your vehicle is damaged in a collision with another vehicle or object, this coverage will help pay for the repairs or replacement of your vehicle.

- Comprehensive Coverage: This coverage protects your vehicle against non-collision-related damages, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: If you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage, this coverage will help pay for your medical expenses and property damage.

- Medical Payments Coverage: This coverage pays for your medical expenses resulting from an accident, regardless of fault.

These are just a few of the coverage options offered by Cure Auto Insurance. By customizing your policy to include the coverage that suits your needs, you can drive with confidence knowing that you are protected in various scenarios.

Customer Reviews of Cure Auto Insurance

When choosing an insurance provider, it’s essential to consider the experiences of other customers. Here are some reviews from satisfied policyholders of Cure Auto Insurance:

- John M.: “I have been insured with Cure Auto Insurance for over five years, and I couldn’t be happier. Their rates are affordable, and their customer service is top-notch. Whenever I had a question or needed assistance, their agents were always friendly and knowledgeable.”

- Sarah T.: “Cure Auto Insurance came highly recommended by a friend, and I can see why. Their claims process was smooth, and they handled everything efficiently. I felt supported throughout the entire process, and my claim was settled promptly.”

- David R.: “I recently switched to Cure Auto Insurance, and the savings were significant. Not only did they provide me with a better rate, but their coverage options are excellent. I feel secure knowing that I am protected with Cure Auto Insurance.”

These reviews highlight the positive experiences that customers have had with Cure Auto Insurance. Their dedication to customer satisfaction and reliable service sets them apart from other providers.

Contacting Cure Auto Insurance – Phone Number and Login Information

If you have any questions or need assistance, Cure Auto Insurance has a dedicated customer service team ready to help. You can reach them at 1-800-123-4567. Additionally, they provide a user-friendly online portal where you can access your policy details, make payments, and file claims. To log in to your account, visit their website at www.cureautoinsurance.com and click on the “Login” button.

Comparing Cure Auto Insurance to Other Providers

When considering an auto insurance provider, it’s important to compare different options to find the best fit for your needs. Cure Auto Insurance stands out in several ways when compared to other providers.

Firstly, their commitment to affordability is unmatched. By offering competitive rates, they ensure that you can protect yourself and your vehicle without straining your budget. Additionally, their flexible coverage options allow you to customize your policy to suit your specific requirements.

Secondly, Cure Auto Insurance’s exceptional customer service sets them apart. Their knowledgeable agents are always there to assist you, whether you have questions, need assistance with a claim, or simply want to review your policy.

Lastly, Cure Auto Insurance is known for their quick and efficient claims process. They understand that accidents can be stressful, and they strive to settle claims promptly, providing you with the support you need during a difficult time.

Discounts and Savings Opportunities with Cure Auto Insurance

Cure Auto Insurance offers various discounts and savings opportunities to help you save on your premiums. Here are some of the ways you can lower your insurance costs with Cure Auto Insurance:

- Safe Driver Discount: If you have a clean driving record with no accidents or traffic violations, you may qualify for a safe driver discount.

- Multi-Vehicle Discount: Insuring multiple vehicles with Cure Auto Insurance can lead to significant savings.

- Good Student Discount: Students with good grades can enjoy discounted rates.

- Anti-Theft Device Discount: Installing anti-theft devices in your vehicle can lower your premiums.

- Paid-in-Full Discount: Paying your premium in full upfront may make you eligible for a discount.

By taking advantage of these discounts and savings opportunities, you can further reduce your auto insurance costs with Cure Auto Insurance.

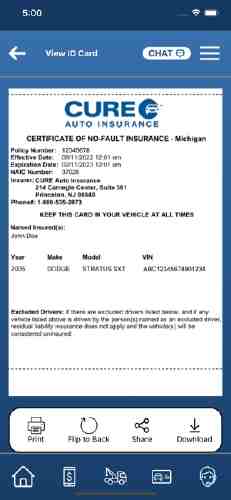

Auto Insurance Requirements in Michigan and How Cure Auto Insurance Meets Them

If you reside in Michigan, it’s important to understand the state’s auto insurance requirements. Michigan is a no-fault state, which means that each driver is responsible for their own injuries and damages, regardless of who is at fault in an accident. To comply with Michigan’s auto insurance laws, drivers must carry certain minimum coverages.

Cure Auto Insurance meets these requirements by offering the necessary minimum coverages, including personal injury protection (PIP) and property protection insurance (PPI). Personal injury protection covers medical expenses, lost wages, and other related costs resulting from an accident. Property protection insurance covers damages to others’ property caused by your vehicle.

By choosing Cure Auto Insurance, you can ensure that you are compliant with Michigan’s auto insurance laws while enjoying the benefits of comprehensive coverage.

How to File a Claim with Cure Auto Insurance

In the unfortunate event of an accident, it’s important to know how to file a claim with your insurance provider. Cure Auto Insurance provides a straightforward claims process to make the experience as smooth as possible.

To file a claim with Cure Auto Insurance, follow these steps:

- Gather Information: Collect all relevant information, including the details of the accident, the other party’s information, and any witness statements.

- Contact Cure Auto Insurance: Reach out to Cure Auto Insurance’s claims department by calling 1-800-123-4567. Provide them with the necessary details and answer any questions they may have.

- Provide Documentation: Submit any supporting documentation, such as photographs of the accident scene, police reports, and medical bills.

- Cooperate with the Claims Adjuster: A claims adjuster will be assigned to your case. Cooperate with them throughout the process, providing any additional information or documentation they request.

- Settlement: Once the claims adjuster has reviewed your case, they will work towards a fair settlement. If you agree with the settlement offer, the process will be finalized.

Cure Auto Insurance’s claims department strives to handle claims efficiently and fairly, ensuring that you receive the support you need during a challenging time.

FAQ

Q: Can I purchase auto insurance from Cure Auto Insurance if I have a poor driving record?

A: Yes, Cure Auto Insurance offers coverage options for drivers with less-than-perfect driving records. They understand that everyone’s circumstances are different, and they strive to provide options regardless of your driving history.

Q: Can I cancel my policy with Cure Auto Insurance at any time?

A: Yes, you have the flexibility to cancel your policy with Cure Auto Insurance at any time. However, it’s important to review their cancellation policy and any potential fees that may apply.

Q: Can I make changes to my policy after purchasing it?

A: Yes, you can make changes to your policy after purchasing it. Whether you need to add or remove a vehicle, adjust your coverage options, or update your personal information, Cure Auto Insurance’s customer service team can assist you with the necessary changes.

Conclusion – Is Cure Auto Insurance the Right Choice for You?

Choosing the right auto insurance provider is a crucial decision that can significantly impact your financial security and peace of mind. With their commitment to affordability, flexible coverage options, and excellent customer service, Cure Auto Insurance emerges as a compelling choice.

By providing comprehensive coverage options tailored to your needs and offering various discounts and savings opportunities, Cure Auto Insurance demonstrates their dedication to ensuring your protection while helping you save on premiums.

Whether you reside in Michigan or any other state, Cure Auto Insurance is equipped to meet your auto insurance needs. Their knowledgeable agents, straightforward claims process, and commitment to customer satisfaction make them a reliable and trusted provider.

So, if you are looking to stay protected and save big, consider Cure Auto Insurance. Reach out to them today at 1-800-123-4567 or visit their website at www.cureautoinsurance.com to get a quote and discover the coverage options that suit you best.

Also You guys can check Karz Insurance Complete Guide Here.