When it comes to credit scores, many Americans wonder what qualifies as “good”—and whether a score of 690 puts them in a strong financial position. If you’re asking “Is 690 a good credit score?”, you’re not alone. Understanding where your credit stands can help you make smarter financial decisions, qualify for better interest rates, and access more favorable loan terms.

In this comprehensive guide, we’ll break down everything you need to know about a 690 credit score, including:

- What a 690 credit score means

- How lenders view this score

- What kind of loans or credit cards you can get

- Tips to improve your score

- And much more

What Is a Credit Score?

Contents

- 1 What Is a Credit Score?

- 2 So, Is 690 a Good Credit Score?

- 2.1 What Can You Do with a 690 Credit Score?With a 690 credit score, you can qualify for many financial products, although the interest rates may not be as competitive as those offered to people with higher scores. Here’s what you can typically expect:

- 2.2 How to Improve a 690 Credit ScoreIf your score is 690, you’re on the right track—but small improvements can unlock better rates and financial opportunities. Here are some smart tips to boost your credit score:

- 2.3 Is 690 a Good Credit Score to Buy a Car?

- 3 Is 690 a Good Credit Score for an 18-Year-Old?

- 4 Trending posts

Before we dive into whether 690 is a good score, it helps to understand what a credit score actually is. In the U.S., the most commonly used credit scoring models are FICO and VantageScore. These scores range from 300 to 850, and they reflect your creditworthiness—or how likely you are to repay borrowed money.

Your score is based on several factors:

Credit mix (10%)

Payment history (35%)

Amounts owed (30%)

Length of credit history (15%)

New credit (10%)

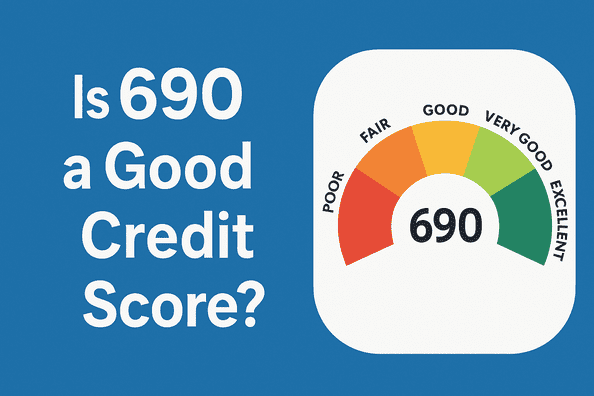

So, Is 690 a Good Credit Score?

A credit score of 690 falls into the “Good” range in the FICO scoring model, which is used by about 90% of U.S. lenders. Here’s how FICO scores are categorized:

| FICO Score Range | Rating |

| 300–579 | Poor |

| 580–669 | Fair |

| 670–739 | Good |

| 740–799 | Very Good |

| 800–850 | Exceptional |

So yes, 690 is considered a good credit score. It’s above average and shows that you’re generally responsible with your credit. However, it’s on the lower end of the “Good” range, which means there’s still room for improvement.

What Can You Do with a 690 Credit Score?

With a 690 credit score, you can qualify for many financial products, although the interest rates may not be as competitive as those offered to people with higher scores. Here’s what you can typically expect:

1.

Credit Cards

- Likely to qualify for most standard credit cards

- May be eligible for some rewards cards

- You might not get premium cards or the lowest interest rates

2.

Auto Loans

- You can likely get approved for an auto loan

- Interest rates may be moderate, not the best available

- A larger down payment may improve your terms

3.

Mortgages

- Eligible for many conventional and FHA loans

- Slightly higher interest rates compared to borrowers with scores above 740

- Consider improving your score to save thousands over the life of a mortgage

4.

Personal Loans

- Many lenders will work with you

- Loan amounts and APRs may vary based on income and other factors.

How to Improve a 690 Credit Score

If your score is 690, you’re on the right track—but small improvements can unlock better rates and financial opportunities. Here are some smart tips to boost your credit score:

✅ Pay Bills on Time

Your payment history is the single most important factor. Set reminders or automate payments to avoid missed or late payments.

✅ Reduce Credit Utilization

Try to keep your credit usage below 30% of your available limit. For example, if you have a $10,000 limit, aim to use no more than $3,000.

✅ Don’t Close Old Accounts

Length of credit history matters. Keep older accounts open to maintain a healthy average account age.

✅ Limit New Credit Applications

Each hard inquiry can drop your score by a few points. Only apply for credit when necessary.

✅ Check for Errors on Your Credit Report

Request your free credit reports from AnnualCreditReport.com and dispute any inaccuracies.

Is 690 a Good Credit Score to Buy a House?

Yes, many lenders will approve a mortgage with a 690 score. However, you might not qualify for the lowest possible mortgage rates, which are often reserved for those with scores above 740.

For example, on a $300,000 mortgage, a difference of even 0.5% in interest could cost you tens of thousands of dollars over 30 years. Improving your score to 720+ could help you save significantly.

How Long Does It Take to Improve a 690 Credit Score?

The time it takes depends on your financial habits and what’s currently affecting your score. With consistent on-time payments and responsible credit use, many people can see meaningful improvement in 3 to 6 months. Major improvements might take up to a year or more.

Bottom Line: Is 690 a Good Credit Score?

Yes, 690 is a good credit score. It means you’re financially responsible and likely to be approved for most loans, credit cards, and other financial products. However, because it sits at the lower end of the “Good” category, improving your score to above 700 or even 740 could make a big difference in terms of interest rates and financial opportunities.

Key Takeaways:

- 690 is a “Good” credit score by FICO standards.

- You can qualify for most loans and credit cards—but not always with the best terms.

- With a few simple strategies, you can raise your score into the “Very Good” or “Excellent” range.

- Always monitor your credit and make smart financial choices to maintain and improve your score.

Is 690 a Good Credit Score to Buy a Car?

Yes, a credit score of 690 is generally considered good for buying a car. Most auto lenders categorize this score within the “good” range, meaning you’re likely to qualify for financing with decent interest rates. While you may not get the absolute lowest rates available—those are typically reserved for scores above 740—you’re still in a strong position. A higher income, stable employment, or a larger down payment can further improve your loan terms. With a 690 score, expect competitive options from banks, credit unions, and dealership financing programs.

Is 690 a Good Credit Score for an 18-Year-Old?

Yes, a credit score of 690 is considered very good for an 18-year-old. At this age, most people are just starting to build their credit history, so having a score in the “good” range puts you ahead of the curve. It shows that you’ve managed your credit responsibly—likely by making on-time payments and keeping balances low. With a 690 score, you may qualify for credit cards, student loans, and even auto loans with fair terms. Just continue practicing smart credit habits, and your score can climb into the “very good” or “excellent” range over time.

Final Tip:

Remember, credit scores are dynamic. Even a small change in behavior—like paying off a credit card balance or setting up autopay—can have a big impact over time. Stay informed, act wisely, and your credit score will thank you.

you can get some more information and apps to check your credit score on this site…

1. What is a good credit score for an 18-year-old?

A good credit score for an 18-year-old is typically anything above 670. Since most people at that age are just starting to build credit, a score of 690 is considered very good and shows responsible credit behavior.

2. Is 690 a good credit score to get a car loan at 18?

Yes, an 18-year-old with a 690 credit score can usually qualify for a car loan. While interest rates may be slightly higher than those with excellent credit, it’s still strong enough to secure financing from many lenders.

3. How can an 18-year-old improve a 690 credit score?

To improve a 690 score, pay all bills on time, keep credit card balances low, avoid applying for too many new accounts, and maintain old accounts to lengthen credit history.

4. Can I get a credit card with a 690 score at 18?

Yes, many credit card issuers offer options for 18-year-olds with a 690 credit score. You may even qualify for a rewards card or a card with a moderate credit limit.

5. Is 690 considered excellent credit for someone so young?

While 690 is not “excellent” by FICO standards (that starts at 800), it’s an excellent start for someone who is just 18. It sets a strong foundation for future financial opportunities.